About

Senior Partner

David is an attorney, consultant, author, and frequent public speaker. He has over 30 years of active practice experience in the areas of wealth transfer planning, charitable planning, trusts and estates, income tax planning and business planning. David has significant experience planning with ultra-high-net-worth families and individuals and working with them in all phases of design, implementation and ongoing support.

David enjoys engaging with individuals, families and business owners to develop and implement plans to achieve their unique goals and objectives by listening to discover, and then working with them to build a plan to implement, their "enlightened dreams" for themselves, their loved ones, their communities and their philanthropic passions.

David also assists public charities and private foundations with navigating the challenging requirements for accepting complex gifts and providing proper documentation to donors and IRS compliance. He also provides training to charitable fundraisers and presentations to charitable donors who are looking to be more tax efficient in their charitable giving.

David has a Masters degree in Taxation from the University of Florida College of Law and has attained the highest professional ranking (AV) from Martindale-Hubbell. He is a member of the Southwest Florida Estate Planning Counsel, National Association of Charitable Gift Planners, Charitable Gift Planners of Southwest Florida, and the Sarasota County and Florida Bar Associations (Sections on Business Law, Tax Law, Real Property and Trust Law).

David is a co-author of Protect and Enhance Your Estate published by McGraw Hill and The Living Trust Workbook published by the Penguin Group. He has been quoted in national newspapers, magazines and appeared as a guest on a number of radio talk shows. David is also a frequent keynote speaker for local and national organizations.

For five years David was the Director of Philanthropic Strategies and Planned Giving at Brown University. At Brown he worked collaboratively with the Advancement office, faculty, staff and alumni as a resource for donors and their advisors to develop and achieve their charitable and financial goals and dreams in a tax-wise manner.

In addition, David looks forward to working collaboratively with other attorneys, CPAs, financial advisors, and insurance professionals to serve the specialized planning needs of individuals, families and business owners.

Awards & Charities

Credentials & Recognitions

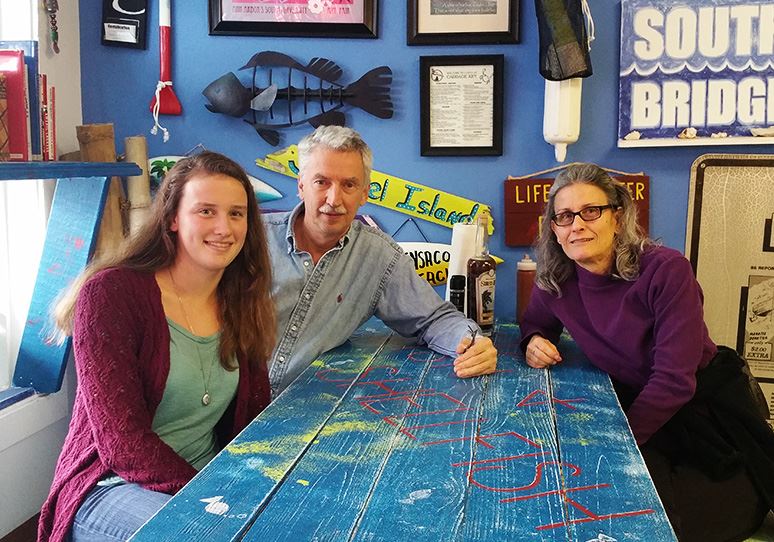

David and his wife Donna's family was born and raised on Siesta Key, Florida. David and Donna enjoy spending time with their two daughters, Sarah and Samantha, exploring our beautiful and ever-changing Southwest Florida environment. They also enjoy being active with Sarasota area charities, including the YMCA.

David is an active member of the Charitable Gift Planners of Southwest Florida and the Southwest Florida Estate Planning Council. David is eager to provide educational presentations to benefit Southwest Florida charitable organizations and to work with donors in the community to maximize their taxwise giving strategies.